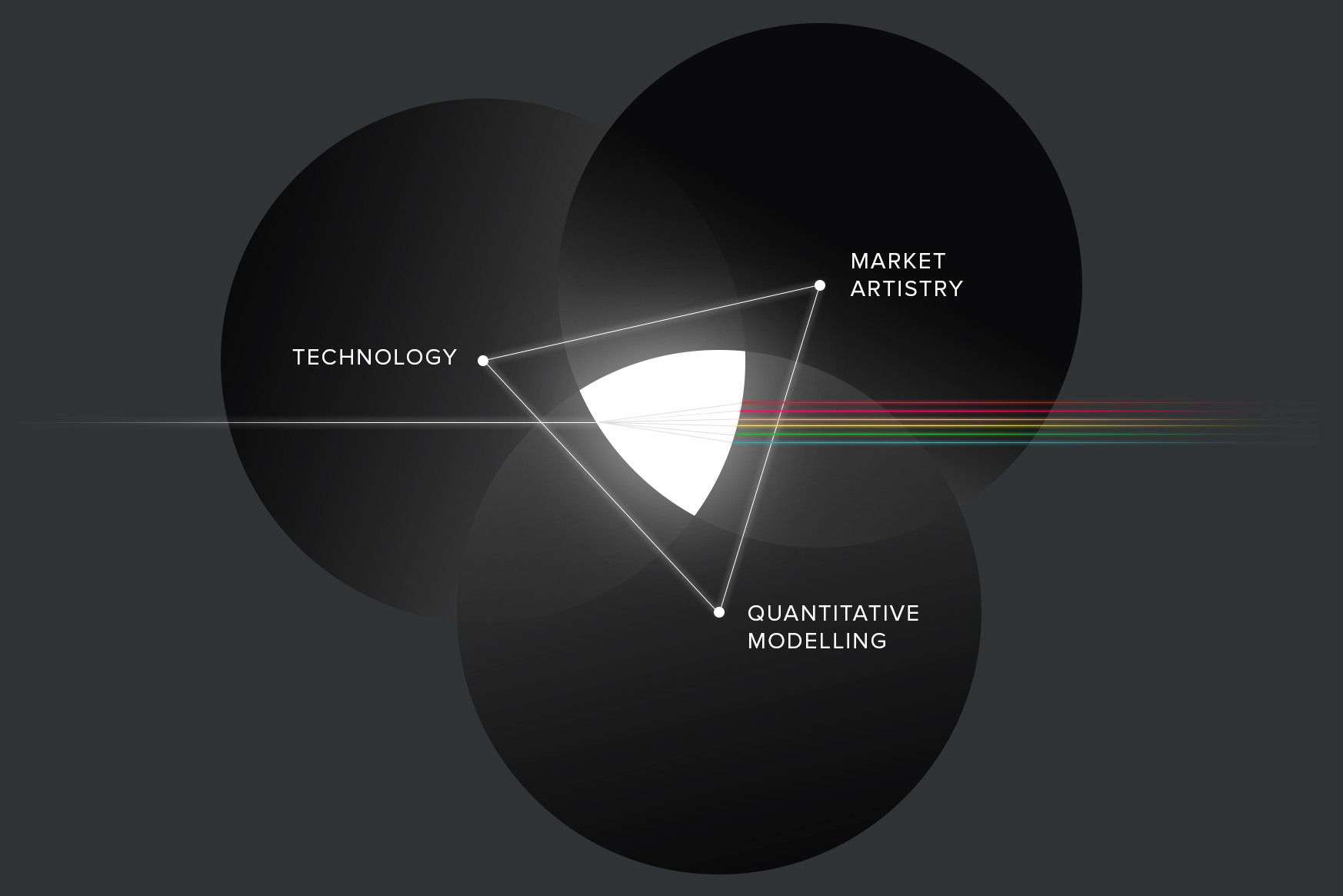

A R&D-focused technology firm first and foremost, we differentiate ourselves from the traditional brokerage model by our alignment of extensive practitioner experience with technological innovation and novel data engineering.

We offer independent, practitioner-led market insights and trading strategies, geared towards highly liquid trading expressions and tailored to a range of investment mandates and risk profiles.

Our proprietary platform, 3fiftyseven®, is a next generation analytical framework that enables us to work with portfolio managers to identify and analyse optimised trading strategies for any given investment thesis.

We carry out highly transparent execution using proprietary software for order handling and synthetic price generation, combined with selected independent third-party execution platforms.

Our operations functions are fully digitised, allowing instant electronic trade confirmation and automated reconciliation and invoicing. This framework drives seamless connectivity from point-of-trade into PrismFP’s post-trade analytical and mobile-enabled monitoring applications.

We actively seek to incorporate the latest advances in data engineering and quantitative methodologies into every aspect of our business. The harnessing of large-scale computational resources via 3fiftyseven®, our proprietary analytics platform, allows us to carry out exhaustive bespoke analyses on behalf of our clients.

We do not take proprietary positions, nor are we biased towards specific axes. Our market practitioners are unencumbered by overarching ‘house views’. We work with our clients to generate and execute bespoke trading strategies, leveraging novel quantitative techniques and cutting-edge technologies over the entire trade lifecycle.

Our edge is derived from the application of advanced technology and quantitative modelling, guided by experienced market practitioners. The FinTech arm of PrismFP has developed a pioneering suite of analytics for strategy optimisation, analysis and risk management. Learn more about this unique platform here.